Generative AI for accounting and finance helps your company detect anomalies in patterns when reviewing financial statements through automation. Your financial accounting system will let you post subsidiary journals and journal entries to the general ledger. For non-routine transactions like M&A transactions, you’ll need to analyze the transaction using worksheets and prepare and record journal entries for the deal. As an accounting https://themors.com/legal-gambling-business-in-europe-the-state-of-online-casinos-in-2025/ period example, businesses use a calendar year with an accounting period start date of January 1 and an accounting period end of December 31.

Latest blog posts

This categorization summarizes and organizes all transactions by account type. Explore the cyclical process that transforms raw financial data into accurate, actionable business insights and essential reports. Another difference between the cycles lies in who the information is intended for. The results in the accounting cycle are intended mainly for an organization’s external audiences, which may include lenders and investors. The budget cycle’s projections are intended strictly for internal use by company management.

The Accounting Cycle: 6 Essential Steps Every Small Business Should Know

If reversing entries are prepared, they happen between Steps 9 and 1. The following diagram includes an explanation along with the various steps or phases of the https://nashastrana.info/why-people-think-are-a-good-idea-4/ accounting cycle. The accounting cycle is actually a stage-by-stage expression of an organization’s accounting activities.

The 8 Give or Take Accounting Cycle Steps for Airtight Bookkeeping

Modern technology now allows businesses to automate significant portions of the accounting cycle, enhancing accuracy while reducing workload. Remember to include the date of invoices and expenses, a description of each transaction, and the affected accounts. Where applicable, I recommend adding an additional entry that addresses tax implications. The most important thing here is standardizing and organizing your transactions.

- That means these companies will structure their accounting cycles accordingly.

- We close temporary accounts, sort out profits or losses, and reset everything for the next period.

- The post-closing trial balance serves as the base or opening trial balance for the next period’s accounting cycle.

- Transactional accounting is the process of recording the money coming in and going out of a business—its transactions.

In addition to fixing errors, adjusting entries might also be needed to incorporate revenue and expense matching principle when using accrual accounting. Preparing an unadjusted trial balance is the next step of the accounting cycle in which a total balance is calculated for all the individual accounts. The bookkeeper will have a choice between cash accounting and accrual accounting depending on his company’s requirements. This choice will determine when the transactions are officially recorded.

Step 2: Record Transactions In A Journal

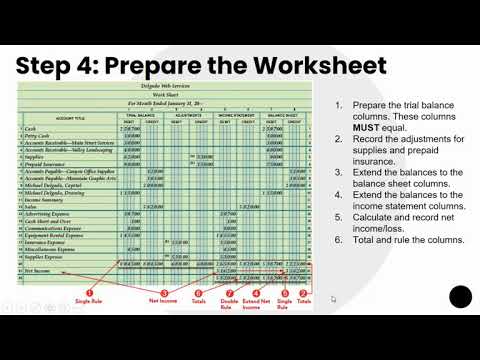

Use worksheets to analyze and reconcile accounts and identify adjusting entries and consolidation entries. When possible, use the capabilities provided by your accounting system. A 10 column worksheet is prepared and the unadjusted trial balance is transferred to the first two columns. All postings to the ledgers are double entry postings and therefore must balance which every debit having an equal and opposite credit entry. The accounting cycle starts by identifying the transactions which relate to the business. The cycle includes only business transactions as the business is a separate entity to the owner.

Persons interested in practicing a regulated profession must contact the appropriate state regulatory agency for their field of interest. For instance, typically 150 credit hours or education are required to meet state regulatory agency education requirements for CPA licensure. Coursework may qualify for credit towards the State Board of Accountancy requirements.

Prepare an Unadjusted Trial Balance

The fifth movement, a repeat of the third, but with a sense of progression. An adjusted trial balance is prepared, reflecting https://italian–charms.com/page/10/ the changes made in the adjusting entries. This means that for every transaction, the total amount debited must equal the total amount credited.