A flexible price range might help mitigate risks by permitting you to make modifications in response to unexpected events. If gross sales and income are relatively steady over the price range period, a hard and fast price range could also be appropriate. If you want to rapidly adapt to adjustments, a versatile price range may help reply to competitive pressures by investing in new instruments and platforms or hiring extra folks. If the owner had chosen a versatile finances as an alternative, they would have set a percentage of gross sales for each expense class. If sales increase during the holiday season, the finances for stock purchases would additionally increase to satisfy demand. Similarly, if sales decreased in off-peak months, the finances for employee salaries might decrease accordingly.

This distinction is essential for organizations that face volatility in market demand, input costs, or capacity utilization. Versatile budgets have some advantages over fixed budgets, similar to being realistic and adaptable to adjustments in exercise or output that will happen through the finances interval. They additionally present a more accurate and truthful basis for performance evaluation and choice making, since they mirror the actual costs and revenues incurred. Moreover, flexible budgets encourage responsiveness and creativity, permitting managers to regulate their spending and methods to the market situations and alternatives. Budgeting is an indispensable device in accounting, enjoying a crucial position in monetary planning, useful resource allocation, efficiency measurement, and value control. A well-prepared finances offers a roadmap for reaching enterprise objectives, guiding strategic decision-making, and making certain financial stability.

Versatile Vs Static Budgets: A Comparative Study

Think About a small boutique retail store that plans its price range for the upcoming 12 months. The proprietor decides on a fixed budget, allocating $5,000 month-to-month for hire, $2,000 for utilities, $10,000 for employee salaries and $8,000 for inventory purchases. Despite potential seasonal fluctuations in gross sales, similar to a major improve through the holiday season or a decrease during off-peak months, this price range won’t change.

Acquire an understanding of operating money flow by way of definition and examples. Companion with Milestone to ensure your operations support your … Variance analysis breaks down why your numbers didn’t match predictions. We’ve seen how figuring out variances is less about pointing fingers and more about uncovering alternatives for enchancment. Like detectives in a world of numbers, we’ve learned to observe the trail left by every variance—to perceive its story, its influence, and its classes. Exploring the ups and downs of adaptable budgeting, we delve into a good evaluation of its efficiency.

- By understanding and implementing sturdy budgeting processes, companies can better navigate monetary uncertainties, optimize useful resource use, and obtain their long-term goals.

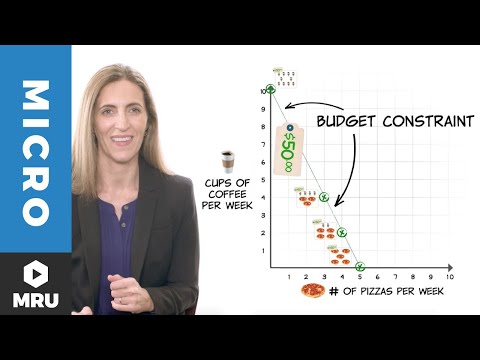

- While a static finances is built on mounted assumptions and remains unchanged once approved, a versatile finances modifies its components in response to real operational results.

- The key’s to choose the right particular person in your organization, and ensure that everyone is conscious of who it’s.

- This adaptability makes it a useful tool for businesses that experience fluctuations in gross sales, manufacturing, or different key metrics, permitting for more responsive and practical monetary planning and management.

- They shift as activity levels change, which suggests you’re all the time working with essentially the most present data.

Income is constantly changing and is an important consider business choices, however the intermediate flexible budget includes prices that fluctuate primarily based on different activity measures. A flexible price range is usually created by identifying the varied prices and bills that fluctuate with adjustments in exercise levels and calculating the expected value or expense for each stage of exercise. A static finances is like setting out with just one https://www.online-accounting.net/ map, regardless of where you finish up wanting to go or what detours you encounter. On the opposite hand, versatile budgets are more like having GPS; they adapt primarily based on precise happenings – site visitors jams or surprise pit stops included. To achieve versatile budgeting, companies want to search out the proper balance between management and autonomy.

Using Sap Finest Practices For Flexible Finances Analysis

Flexible budgeting additionally comes into play with headcount planning. For example, if you’re forecasting group member advantages, you can tie that budget line to your headcount projections—so the benefits finances scales routinely as your staff grows, based mostly on a per-person price. It’s about learning, adjusting, and shifting ahead with grace—even when the financial winds change course unexpectedly. SAP systems act not merely as devices but as collaborators, steering us towards enhanced productivity and expansion at every juncture.

It’s this last point that’s so crucial, however which is usually missed by corporations considering versatile budgeting. In the final section we’ll look at why it issues a lot, and how one can keep away from making this common mistake. Versatile budgeting depends on sturdy financial assumptions, particularly when linking variable line gadgets to business drivers. Trying to force connections the place they don’t exist can create noise and reduce forecast accuracy.

When you’re taking a look at present operations and there are no important modifications, they should feel empowered to act and know they will be supported of their selections. The extra that dynamic shifts appear probable from many directions, the more companies start on the lookout for flexibility and the agility that comes with it. Paradoxically, the increase in agility can make companies more stable, as a end result of as a substitute of floundering they’ve a plan after they want it. There was a course of, usually beginning 3-5 months before the start of the model new yr, which resulted in a fixed budget damaged down by department. The process may be prime down or backside up, or a mixture of the two, however the outcome was pretty close to etched in stone. These are the income patterns you should think about when deciding whether or not to implement both mounted or variable budgets.

What’s The Variance Analysis Of The Budget?

It’s primarily based on a set of assumptions made firstly of the budgeting period. It scales in response to shifts in variable costs—expanding or contracting as needed to reflect what’s truly happening in the business. The main options of a flexible price range embody scalability, responsiveness, and continuous alignment with organizational aims.

The aim right here is that can assist you, the enterprise proprietor, pick the budget that fits your corporation finest. This will enhance your decision-making and help your business succeed financially. A versatile advantages of flexible budget finances may be created that ranges in level of sophistication.

This signifies that the variances will doubtless be smaller than under a static finances, and also will be extremely actionable. At the shut of each interval, you’ll examine projected revenue with actuals and adjust future expenses accordingly. The difference between what you deliberate and what really happened is your versatile finances variance—a key metric for understanding how accurate your forecasting really is.